puerto rico tax incentive program

Depending on the services you select you can setup either a bank fund manager investment advisory firm family office etc. And within the first two years of living there you now need to buy a home in Puerto Rico.

House Rent Allowance Exemption Tax Deductions Tax Deductions Being A Landlord Income Tax Return

With Puerto Ricos tax incentive program you select from a menu of services you wish to offer.

. While other tax havens are adding 1 or 2 banks a year Puerto. We have reviewed the language of the new law and are pleased to share the major changes to Act 20 and 22 programs below. The findings were the following.

Puerto Rico requires to invest in competitive activities of high economic value and positive performance. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. And Puerto Ricos Act 273 has been an amazing success.

22-2016 provides up to 11 energy credit if the tourism activity is endorsed by the PRTC and complies with the requirement stated in this form. 100 tax exemption from Puerto Rico income taxes on all short and long-term capital gains accrued after the individual investor becomes a bona-fide resident of Puerto Rico. Puerto Rico - Green Energy Fund Tier I Incentive Program.

Make Puerto Rico Your New Home. The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities. Then in April the Governor signed new legislation which raised the annual filing fee for Act 22 from 300 to 5000.

Ad We file Puerto Rican Hacienda US and Canadian returns. The Act 20 program was designed to enable eligible businesses to make use of a variety of tax exemptions as long as the business is based inside Puerto Rico and has its clients located outside of Puerto Rico. Puerto Rico has created an aggressive tax incentive program to connect with the global economy to establish an ever-growing array of service industries and to establish as an international service and trading hub center.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. The existence of 58 incentive laws or programs to promote economic activities. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS.

In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. 22 which provides tax. The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000.

In 2017 the Economic Development Department conducted a study to evaluate the cost and performance of the economic incentives granted. In the past few foreign investors have found the EB-5 Classification attractive due to the tax consequences on the investors worldwide income upon moving to the United States. Puerto Ricos recently approved Act to Promote the Transfer of Investors to Puerto Rico Act 22 of January 17 2012 Act No.

Puerto Rico offers a 30 tax deduction up to 1500 for expenses incurred in the purchase and installation of solar equipment to heat water for residential use. A self-governing territory of the US Puerto Rico has authority over its internal affairs including certain exemptions from the Internal Revenue Code. PRIDCOs Infrastructure Incentive Program provides grants to help companies with numerous permanent leasehold improvements such as installation of.

Solar equipment is defined as any equipment capable of using solar energy directly or. Act 20 was renamed the Puerto Rico Export Services Tax Incentive and became Chapter 3 of Act 60 while Act 22 was now called the. Read more about Puerto Rico.

Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Fixed income tax rate of between 4 and 10 100 exemption on. Production Incentives 40 Production tax credit on all payments to Puerto Rico Resident companies and individuals 20 Production tax credit on all payments to Qualified Nonresident individuals Persons engaged in qualifying film projects are eligible for the following preferential tax rates and exemptions.

The Greatest Homemade Doughnut Recipes You Ll Ever Find Huffpost Life Prepaid Debit Cards Irs Best Us Presidents

Move In And Move Out Inspection Agreement P1 Of 2 Being A Landlord Finding A House Moving Out

Baidu And Alibaba Best Yahoo And Twitter For Digital Ad Revenue Ads Digital Marketing Digital

White House Emphasizes Promise Of New Tax Credits In Puerto Rico Puerto Rico Report

Chairman Neal Gets Puerto Rico Tax Credits Over The Finish Line Puerto Rico Report

Federal Response Getting Puerto Rico Back On Its Feet The Epoch Times Newspaper Editorialdesign 신문 디자인 레이아웃 신문

Puerto Rico Tax And Incentives Guide Grant Thornton

Pin On Family Economic Security

Input Tax Credit Under Gst Proper Manner Of Utilisation With Example Tax Credits Legal Services Reconciliation

Can You Still Get A Tax Credit For An Electric Car Experian In 2022 Tax Credits Hybrid Car Mazda Cx 30

Move In And Move Out Inspection Agreement P1 Of 2 Being A Landlord Finding A House Moving Out

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Printable Eviction Notice Template Pdf Sample Eviction Notice Letter Templates Free Being A Landlord

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

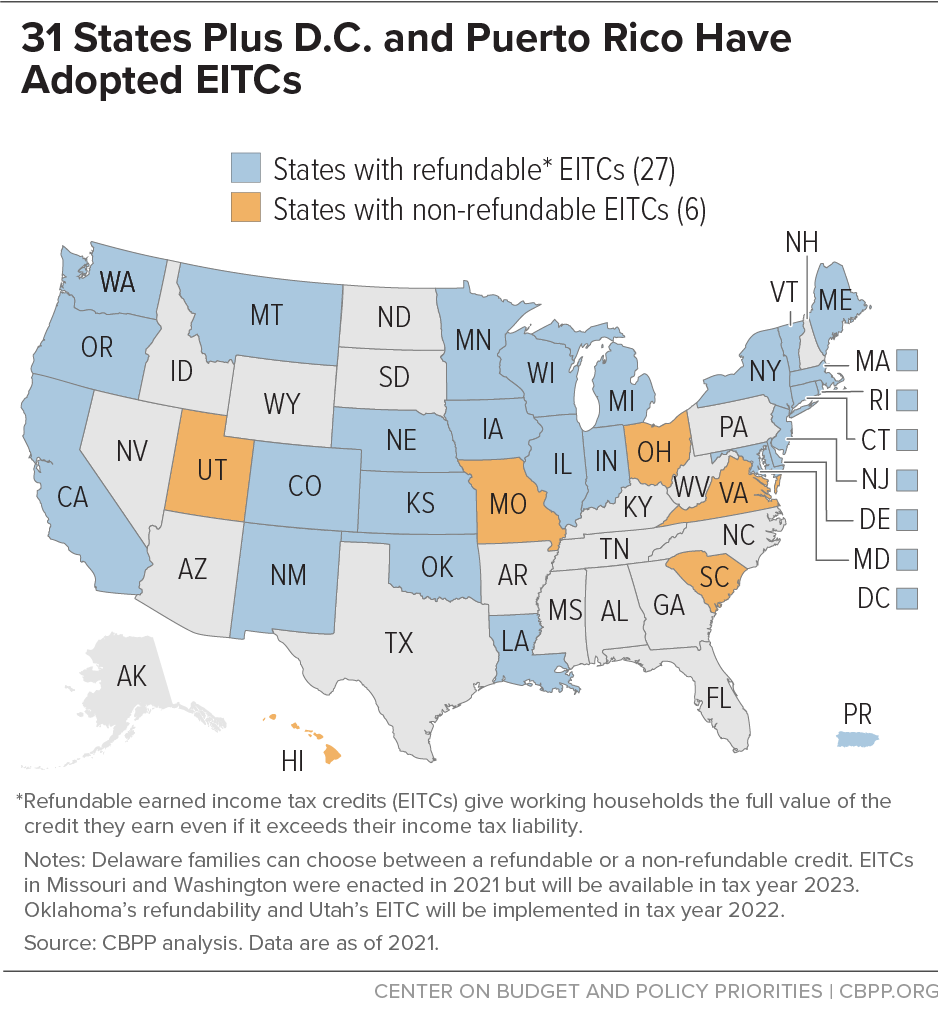

31 States Plus D C And Puerto Rico Have Adopted Eitcs Center On Budget And Policy Priorities

Teatro Yaguez En Mayaguez P R Mayaguez House Styles Mansions